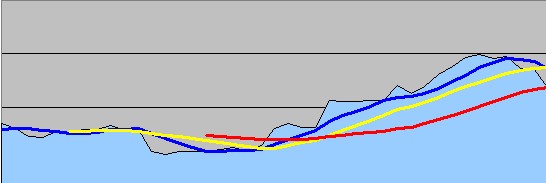

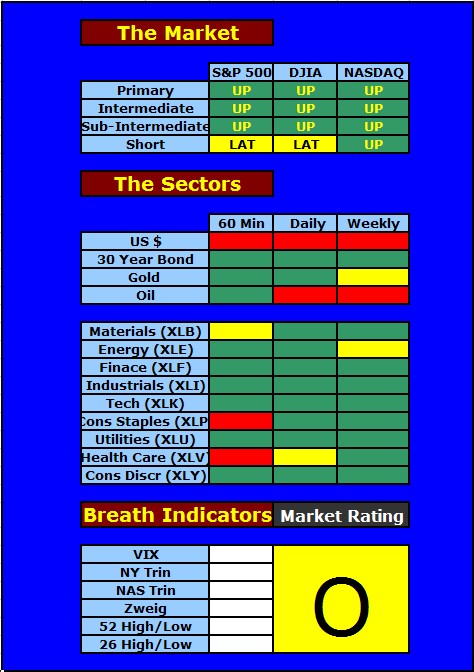

We had a nice follow through on the spike up in the $VIX. It happened fast this time. The good numbers always help. I also want to make note that the market is focusing more on the good number rather than the bad at this time. I guess the real test will be the prior swing high. I’ll be watch for that to become resistance due to the deep pullback we just had. The DJIA is still the strong one in the heard. The bonds are still at new highs and looking for support at 113 to hold. Oil is showing the first sign that the slide could be over, so they can jack the prices back up during the winter months. The Dollar and Gold and battling here. A drop in the dollar under the 80 point could mean some serious issues for the overall stock market.

My plan is to play this back up to the old swing high and get real tight when, and if, that happens. My stock plays are focusing to the long side. Here is my first run:

Long Ideas:

SXE

ACOR

ASCA

BYD

FCX

DLB

Short Ideas:

WSM

From Trading Quotes:

Survive first and make money afterwards.

George Soros

A great read on the Different Players in the market from Traderfeed.

So you have figured out that trading is hard, here is a great Comparision from Tyro Trader.

You wants some hard Market Numbers – Bill Rempel has them for you.

Here’s Maoxian’s Top Ten Links.

Here is a must read that I got off Trade Mikes Links about Trading Plans.