Recap

Not to much happened today that makes me have much to say, I think CNBC and the rest of the news will tall you all about it. We are just continuing the established trend. We had a nice set up yesterday to go long today in the market. I just can’t help but to think this doesn’t feel right. Its like I’m searching for a reason or indicator to justify my thoughts. I know how well that tends to work out for me.

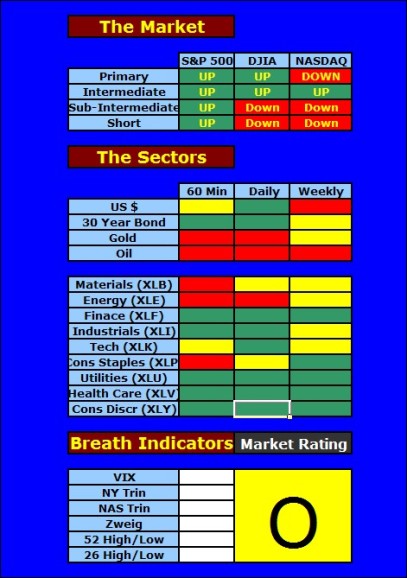

The DJIA is the obvious winner in all this while the NASDAQ just fails to come along for the party. Gold takes a good smack down near the 575 support area, all in one day. Oil seems to be taking all the war premium out in a few months, I feel safer. The US $ just keeps winding itself up to a crazy tight range. I think I agree with the experts here – do you believe the bonds outlook for the economy, or do you listen to stocks? This answer will come hard and fast during earning season.

Strong Areas – Last Month:

Home Furnishing Stores, Auto Parts Stores, Electronic Stores, Major Airlines, Sporting Good Stores, Textile – Apparel Footwear, Catalog & Mail Order, Printed Circuit Boards, Discount Stores, Apparel Stores

GCO, CBK, GPS, AEOS, CHRS, ANF, MW, JNY, BJ, WMT, FLEX, JBL, CROX, COH, NKE, BBY, ORLY

Nice Looking Tau Long Stocks:

TWTC, SEIC

Weak Areas – Last Month:

Medical Practitioners, Silver & Gold, Oil & Gas Stuff, Industrial Metals, General Contractors, Drug Stores, Energy, Medical Labs

CHAP, STLD

Nice Looking Tau Short Stocks:

RS

Interesting Tight:

AAWW, HAE, CERN, UIC, AMN, IDXX